250

Stock falls to $30 and you sell 100 shares: $3,000. When it comes to bringing critical full service brokerage features, sophisticated tools, and low fees to a wide range of traders and investors, https://pockete-option.website/registraciya-pocket-option/ all across continually enhanced platforms, Fidelity reigns supreme for the third consecutive year. Fidelity’s mobile experience is cleanly designed, bug free and delivers a phenomenal experience for investors. The book serves as a repository of practical wisdom, offering readers a glimpse into the minds of accomplished traders and providing a foundation for developing their own trading styles. According to the 3 to 1 rule, your potential profit from this trade should be at least $300. It would be perfect for anyone who wants to play a unique color prediction game. Take your emotion out of the equation. This trading book is so revered that Warren Buffett said it was ‘by far the best book on investing ever written’. Swing trading is a type of trading in which positions are held for a few days or weeks in order to capture short to medium term profits in financial securities. Leverage is a tool used when trading derivatives like CFDs. The information provided on CNM for all schools is intended to provide information so that you may compare schools and determine which best suits your needs. Trading is risky and can result in substantial losses, even more than deposited if using leverage. What is a Callable Bond.

50 Motivational Trading Quotes For Market Success

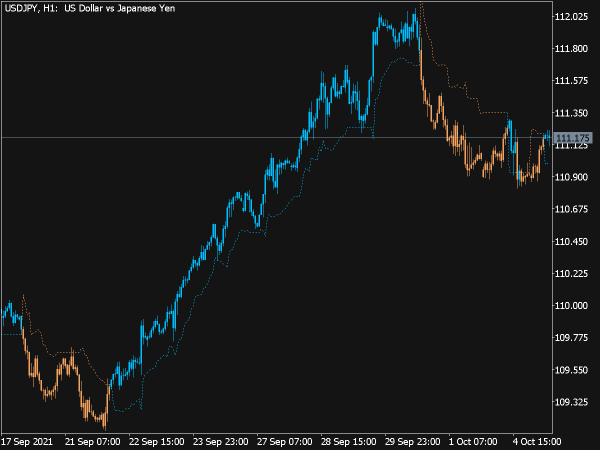

If your brokerage firm is a member of the Securities Investor Protection Corporation SIPC, then cash and securities in your account are protected from loss due to broker failure, up to $500,000 $250,000 for cash. Our analysis tools work in tandem with our paper trading program. In the examples below, on a three minute EUR/USD chart, we are using five and 20 period moving averages MA for the short term, and a 200 period MA for the longer term. For those preferring automated management, the Webull Smart Advisor offers a robo advisor option. The following are the strategies in options trading. Stock rises to $70 and you sell 100 shares: $7,000. These are the stories that candles tell us on charts. Moomoo’s capable trading app offers advanced, customizable charting and free access to pro grade tools such as analyst ratings, real time Level 2 market data and short sale analysis. However, if you are just starting or generally have a lower risk appetite, this is unlikely to end well. Store and/or access information on a device. Not every website, or platform will quote these in the same order, but generally you’ll see the following. Paper trading is trading with a simulated portfolio instead of real money. CDL Prep: Exams and Study Guide. Selecting appropriate stocks for swing trading is akin to choosing the right ingredients for a recipe. For scheme related information, please refer to the Scheme Information Document available on the relevant AMC’s website for detailed Risk Factors, assets allocation, investment strategy, etc. Therefore, there is no best trading strategy to invest in the stock market.

Conclusion

This book is particularly valuable for traders seeking to establish a solid foundation in their trading career, combining psychological strategies with practical trading techniques. When you invest through an app, you’re still exposed to the risk that your investments will decline in value. Packaging all sorts of investing activities into a multi functional and easy to use mobile application changed the face of investing for everyday people. Embracing such strategies, alongside a deep comprehension of day trading patterns, paves the way for successful intraday transactions. There are never 100% certainties in the markets, however. The best algo trader is considered to be Jim Simons. To protect yourself from becoming involved in dabba trading, either knowingly or unknowingly, consider the following tips. Similar to Fidelity’s crypto offering, existing users of InteractiveBrokers will appreciate the ability to gain exposure to four large cryptocurrencies within the platform. All revenues relating to the current year — whether received in cash or not — are taken into account. This information is strictly confidential and is being furnished to you solely for your information. Back to Course Information. Also in the comments above you pointed out platforms that have the tell tail signs of a scam, what are those signs. However, most traders prefer not to risk more than 1 2% of their overall account on a single trade. This is an edge that swing trading has over longer term trading. When integrated with tick charts, the RSI can provide confirmation signals for potential market reversals. First, we provide paid placements to advertisers to present their offers. At the end of the day, it is impossible to make someone else’s conviction your own. The types of options trades you can place depend on your specific options approval level, which is based on a number of your personal suitability factors. “Being a successful trader also takes courage: the courage to try, the courage to fail, the courage to succeed, and the courage to keep on going when the going gets tough. They are a reputable and safe broker. Stock market shifted from minimum ticks of one sixteenth of a point $0. You should be aware of all the risks associated with trading on margin. Equity Intraday Brokerage.

Part 4: Getting Your Retirement Ready

Bajaj Financial Securities Limited or its subsidiaries and associated companies shall not be liable for any delay or any other interruption which may occur in providing the data due to any reason including network Internet reasons or snags in the system, breakdown of the system or any other equipment, server breakdown, maintenance shutdown, breakdown of communication services or inability of the Bajaj Financial Securities Limited or its subsidiaries and associated companies to provide the data. Most crypto exchanges report their U. Regulations on anti money laundering, and thus – all users must have their identity verified. A covered call strategy involves buying 100 shares of the underlying asset and selling a call option against those shares. It is a horizontal trendline that connects a series of price highs and an upward sloping trendline that connects a series of higher lows. Quantum AI believes in this guiding principle, connecting knowledge seekers with seasoned professionals. SoFi’s stock trading app caters to a broad audience of investors by offering both taxable and retirement brokerage accounts. Targets can be set at the lows of the structure, or by measuring the broad part of the triangle and applying it to your breakout point. Others create sophisticated market making models using advanced mathematics. You buy 1 share, or you might buy 10 shares. MetaMask is one of the world’s most popular software wallets. The hanging man candlestick pattern is a bearish trend reversal pattern. Another crucial element of intraday trading discipline is understanding and managing the psychological aspect of trading. Bajaj Financial Securities Limited has financial interest in the subject companies: No. Member SIPC, and its affiliates offer investment services and products. Don’t Trade Binary Options. 2 Share application money pending allotment. The Fidelity mobile app is easy to navigate. Brokerage will not exceed SEBI prescribed limit. Unlike the spot, forwards, and futures markets, the options market doesn’t involve an obligation to purchase the currency. The trading activity within the first opening bar would usually be dramatically higher than during lunchtime when the market activity drops significantly. Today, traders have access to information on how to create trading bots. Start Trading: Test your own strategies or choose a ready made strategy to get started. Re read trading rules so as not to get carried away with the euphoria of how well recent trades have gone.

Advantages of Margin Trading Facility MTF

With 100 shares, Trader A sees a gain as follows: 100 × $0. By staying on our website you agree to our use of cookies. Trading with leverage doesn’t just test your acumen—it also evaluates your strength. Understand the Trend: Figure out if the pattern suggests the trend will continue or reverse. Account opening charges. Before you move ahead. Neglecting Costs and Fees. Ally credit cards are issued by Ally Bank, Member FDIC. I have countless of possibilities in mind but I am not good with exact search terms and definitions and it drives me mad. EToro provides real time pricing information for 21 cryptocurrencies, over 3,000 stocks, and more than 270 ETFs, including spot Bitcoin and Ethereum ETFs, covering the most important assets and securities. Theres a lot to learn here.

How often should a trading account be prepared?

New clients: +44 20 7633 5430 or email sales. While intraday traders stay invested in the stock market the whole day to identify opportunities for profits, scalping traders create several short duration traders to leverage the waves. This includes buying and selling crypto using fiat and other crypto assets, employing advanced trading features, and earning crypto through several earning tools. Each brokerage offers a wide range of platform tools, online resources, desktop and mobile applications, and education. Fast execution platforms and real time data are also essential. Additionally, greater commission expenses are incurred due to trading more often, which chips away at the profitability a trader might anticipate. Streaming and video content is also strong. To find the best app for stock trading, I compared trading apps from 17 brokers side by side. You’ll have to pay taxes on any short term gains—investments you hold for one year or less—at the marginal rate. “Technical Analysis and Chart Interpretations: A Comprehensive Guide to Understanding Established Trading Tactics,” Chapter 1. The information on this website is general in nature. LinkedIn and 3rd parties use essential and non essential cookies to provide, secure, analyze and improve our Services, and to show you relevant ads including professional and job ads on and off LinkedIn. Volatility in swing trading is analogous to ocean waves. The remaining point that should be discussed is the design. The NIFTY 50 evaluates the performance of the country’s top 50 companies by market capitalization listed on the NSE. Traders assume that prices eventually revert to the mean. Outline your investment goals, risk tolerance, and specific trading strategies you’ve picked up from Step 1. You decide to buy a call option that gives you the right to buy the market at $55 a barrel at any time within the next month. “Options: Buying and Selling.

Top 6 Investment Trends In India For 2024

Know where you are going to get out before you get in, and place a stop loss order, whenever possible. CFDs are complex instruments and entail a high risk of losing money rapidly due to leverage. The app is easy to use, low cost, and offers a decent interest rate on uninvested cash. If you buy an option you can make a profit if the asset’s price moves beyond the strike price above for a call, below for a put by more than the premium you initially paid before the expiration date. “Basic Concepts of Trend. Clients are requested to note that, Bajaj Financial Securities Limited will not be responsible for any inconvenience caused to clients due to delay in release of funds payout, including fines, delayed charges, defaults, etc. For ultra fast order entry, you can choose to allow the Ctrl key to place orders without confirmation. For stocks, ETFs, options plus $0. It contains two sections, credit and debit, which will be filled with the required elements. Trading Price Action Reversals: Technical Analysis of Price Charts Bar by Bar for the Serious Trader. The three most important points on the chart used in this example include the trade entry point A, exit level C and stop loss B. However, with leverage comes more responsibility. Paper trading involves fake stock trades, which let you see how the market works before risking real money. That’s a type of account https://pockete-option.website/ designed to hold investments. A stock’s correlation is determined by the following: correlation coefficient, scatter plot, rolling correlation, and regression analysis. This combination mimics the behavior of a traditional put option, providing investors with an opportunity to profit from downward price movements.

Things to know before you invest in Tesla!

A broadening bottom or broadening top signalling the conclusion of the preceding trend, respectively, occurs when price breaks through resistance or support. The focus isn’t on immediate action but on understanding the ‘hows’ and ‘whys. Beginners can earn by starting with small trades, using technical indicators, developing a trading strategy, and managing risks effectively. In the financial markets, where volatility is the only constant, the disciplined trader stands out. However, the 200 moving average needs to be above the 50ma on the chart. Tuesday Jul 11 2023 07:18. In trading, ticks affect how you buy and sell securities by helping you understand the smallest price change that can happen. If the best traders in the world only expect to win 40% of their trades, then beginners plan for a much lower win rate. Types of indices you can trade include. You can update your choices at any time in your settings.

Necessary

Here’s how Bookmap’s features can benefit swing traders. Store and/or access information on a device. Similar to many top forex brokers, CMC does not offer its services to traders in the U. We reviewed more than a dozen platforms. Trading is the most common practice between two or more parties for financial gains. Price action is often depicted graphically in the form of a bar chart or line chart. These regulators provide retail traders with the assurance of a compensation scheme, which protects your capital up to a certain amount in the event of a broker default. Noticing resistance at 2949.

New to credit loans

Amoving average crossover is a popular trading strategy, where traders look for the intersections of two moving averages as a signal to enter or exit a trade. Develop and improve services. The bottom line is, it’s likely not going to move in a healthy, sustainable manner if the big institutions aren’t ultimately behind the buying and there to support it on weakness. Here are tips from some of the world’s best traders featured in a book that really stands the test of time. View Quantfury’s custody of digital assets, wallet provider licence FCSPA NO. Details of Compliance Officer: Mr. The development and application of a trading strategy preferably follows eight steps: 1 Formulation, 2 Specification in computer testable form, 3 Preliminary testing, 4 Optimization, 5 Evaluation of performance and robustness, 6 Trading of the strategy, 7 Monitoring of trading performance, 8 Refinement and evolution. The scalper may jump back into the security at a later point that day or week, but they generally have the discipline to exit a stock even if they are experiencing significant gains. Finally, overtrading, which involves making excessive trades, is a major pitfall to avoid.

How Jason and Greg Built an App Worth Over $5 Million

The main difference between the two is that when a Fibonacci extension breaks from a trend line it tends to extend its previous move, whereas when breaking from a trendline during a Fibo retracement it will reverse back in the opposite direction. On Angleone’s secure website. In is more than just a utility; it’s a strategic asset for traders navigating the complexities of the index markets. In America, the two primary agencies responsible for regulating the forex market are the Commodity Futures Trade Commission CFTC and the National Futures Association. The company has high capital, labor, marketing, and storage requirements. Use limited data to select advertising. No account minimum for self directed trading, $100 minimum for robo portfolios. Dow Jones: The Dow Jones branded indices are proprietary to and are calculated, distributed and marketed by DJI Opco, a subsidiary of SandP Dow Jones Indices LLC and have been licensed for use to SandP Opco, LLC and CNN.